Some UK breeders have recently received letters from HMRC requesting them to make “voluntary disclosures” of income from pet sales. The new “clampdown” aims to address unregulated breeding operations and ensure breeders are reporting their earnings accurately.

This guide helps you understand what this means for you as a breeder and gives tips on how to respond confidently.

About HMRC’s clampdown on dog breeding

You may have seen that breeders are receiving letters from HMRC about “voluntary disclosures”, or perhaps you’ve received one yourself.

With pet ownership growing in popularity, especially since the pandemic, HMRC is focusing its attention on dog and cat breeders to ensure fair and transparent income reporting.

The letters invite breeders to declare any unreported earnings from the sale of pets, and is part of a broader effort to ensure responsible breeding practices and improve animal welfare across the UK.

At Breedera, we understand that this kind of letter might cause concern, especially when your main focus is on your dogs’ wellbeing. But don’t worry, we’re here to walk you through what to expect, how to respond, and why it matters.

Phew!

If you receive a letter, it doesn’t mean you’re being targeted for wrongdoing – it’s just part of a broader check to make sure breeders are on the same page with tax regulations.

What is HMRC “Voluntary disclosure” for dog breeders?

Voluntary disclosure is a way to report any income from breeding that might have slipped through the cracks. Maybe you’re only selling a litter or two a year and didn’t think it would count – but HMRC is now asking all breeders with earnings over £1,000 (after expenses) to come forward.

By taking this step now, you’re showing HMRC that you’re responsible and proactive. It’s a way to build trust and keep things above board. Plus, making a voluntary disclosure now can help you avoid the more time-consuming and potentially costly path of a formal investigation down the road.

How to respond to HMRC as a dog breeder

Receiving a letter from HMRC doesn’t have to be stressful. Here’s a step-by-step plan to help you respond effectively.

Gather all your records

Review all your income and expenses related to your dog breeding activities, such as receipts, invoices and bank statements.

Consult a trusted accountant

An accountant familiar with small businesses can help you review your earnings and expenses to make sure everything is in order. Often, your first initial discussion is free, so it’s worth reaching out.

Consider registering for Self Assessment

You may have to declare income from the breeding or sale of animals if your sales exceed the tax-free trading allowance of £1,000 for a tax year. Some other factors also apply, including if you have any other taxable income.

Typically, the best way to declare this income is via Self Assessment.

If you’re not already registered for Self Assessment, now’s the time.

HMRC wants breeders to report income accurately and filing a Self-Assessment is a straightforward way to do it.

Here’s how to register for Self Assessment.

Different types of HMRC investigations

Not all HMRC enquiries are the same, so don’t let the thought of an investigation worry you too much. Here are the main types:

Voluntary disclosure

The most common and straightforward type, where you’re simply asked to report any unregistered income.

Voluntary disclosure is what is typically being asked of dog breeders in the UK right now.

Aspect enquiry

HMRC may ask questions about specific areas of your finances, such as a certain sale or expense.

Full enquiry

A full enquiry from HMRC is much less common and typically reserved for cases where HMRC believes there may be significant issues. With voluntary disclosure, you’re taking control and reducing the chance of this happening.

Phew!

Most breeders will only need to make a voluntary disclosure, which is quick, easy, and puts you on solid footing with HMRC.

Do dog breeders pay tax?

In short, yes, if you earn enough from sales.

All dog breeder’s must declare income earned from selling puppies if their total income exceeds £1,000 per year. HMRC considers this a trading activity, so it must be reported through Self Assessment.

However, the amount of tax you pay depends on different factors including:

- how your breeding business is legally set up – i.e. Limited Company, Sole Trader etc

- if you have any other taxable income

- how much of your income is above your Personal Allowance

- how much of your income falls within each tax band

You can get a full breakdown on the HMRC website or speak with an accountant about your personal situation.

HMRC tax deductions for dog breeders

Dog breeders can claim tax deductions for legitimate business expenses, such as:

- Veterinary bills

- Food and supplies*

- Breeding registration fees

- Advertising and marketing

- Costs of maintaining breeding facilities

*Only applicable to spending above and beyond your normal expenses for keeping your dogs as pets. So, usually, this is reserved for puppy food for the litter or pregnancy-specific nutritional expenses.

Keep accurate records of all expenses to ensure compliance and maximise deductions.

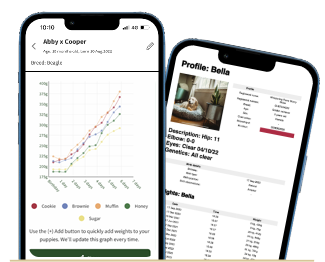

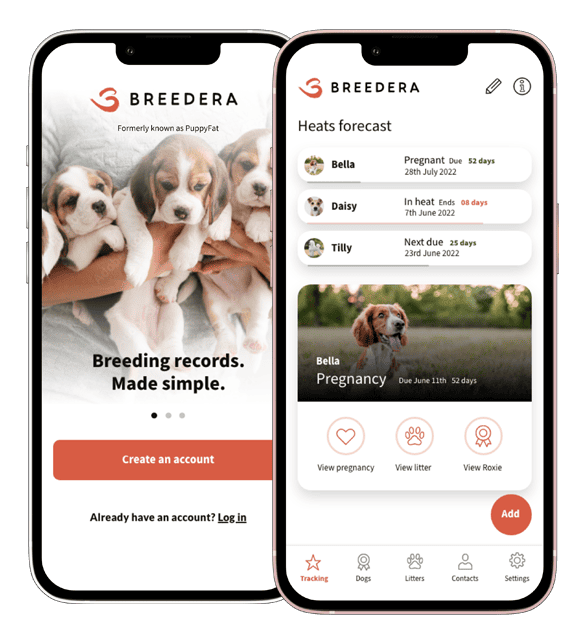

With Breedera, you can keep an accurate record of all your dog breeding activity and expenses.

Simply snap your receipts and upload them to the Documents of any dog. The same can be done with your contracts of sale.

Breedera gives you peace of mind that all your essential breeding records, health history and buyer information are in one easy-to-access place.

If you have any further questions, or need additional advice, check out our free online dog breeding community – it’s a safe space where you can post anonymously and other breeders in the group can share their experiences with you.

Disclaimer:

The information provided in this article is for general informational purposes and is not intended to be a substitute for professional or legal advice. The content shared here is based on thorough research, personal experiences and the collective knowledge of the dog breeding community. Contact a qualified accountant for bespoke advice on taxation.

By Courtney Farrow

Courtney supports Breedera with all our online content. Specialising in heart-led copywriting for purpose-driven brands, she is passionate about Breedera's mission to make responsible breeding practices easy and rewarding and champion more traceability and transparency in the pet industry.